Abstract

The Texas deregulated electricity market offers consumers a vast array of choices, yet selecting the most cost-effective plan can be a challenge. This study investigates the discrepancies between expected rates and actual costs, utilizing interval usage data from 501 participants in the Dallas and Houston metropolitan areas.

Key findings reveal that real rates deviate from expected rates by up to 45%, with many consumers lacking the tools to accurately compare plans. Despite 87% of surveyed consumers prioritizing cost, 98% did not select the least expensive option when given a choice. The study underscores the need for tools to help consumers better understand and select the most cost-effective electricity plans.

Introduction

Free nights and weekends plans are popular. Do they make sense for most Texas homeowners?

Our study takes 501 Texas homeowners and does a thorough analysis to determine which type of energy plan is best for each one. We use actual energy usage for each home and calculate the bills these homeowners would receive for each plan over a 12 month period.

To capture the energy plans that most people would encounter, we include the most heavily advertised plans and also those that rank the highest on popular comparison websites.

The study compares:

- Traditional plans

- Free nights and weekends plans

- Bill credit plans

- Device specific plans (like plans for electric vehicles and smart thermostats)

- Tiered rate plans

Background

In 2002, Texas deregulated its electricity market, breaking up the monopolies held by regional utilities and allowing consumers to choose their electricity providers. This move aimed to foster competition, drive down prices, and encourage innovation in the energy sector. Deregulation provided consumers with the "power to choose" from a variety of electricity plans, transforming how electricity was bought and sold in the state.

Since deregulation, the Texas electricity market has experienced significant growth. As of 2024, the Public Utility Commission of Texas (PUCT) reports that there are over 130 Retail Electric Providers (REPs) (“Alphabetical Directory of Retail Electric Providers”) in Texas, offering a wide array of plans. Consumers can shop for electricity plans directly with the providers directly or through shopping comparison sites such as, powertochoose.com, the state-sanctioned website. Each platform showcases different variations of plans, providing consumers in deregulated areas with hundreds of options.

While the variety of plans allows consumers to find options that align with their seasonal usage patterns and financial goals, the complexity of these plans often leads to confusion and, in some cases, higher-than-expected electricity bills.

Problem Statement

Despite the apparent variety and competitive rates, there are significant discrepancies between the advertised rates and the actual costs incurred by consumers. Advertised rates often apply to specific usage amounts listed on the Electricity Facts Label. Calculating the true cost for every month of the year requires time and tools that the average consumer may not have. This complexity can lead to potentially higher-than-expected rates and dissatisfaction.

Objectives

The primary objectives of this study are:

- To determine the actual costs consumers pay for different advertised plans based on interval usage data.

- To compare the actual rates of highly advertised electricity plans, plans on powertochoose.com and popular third party websites.

Regulatory Rules

The Public Utility Commission of Texas (PUCT) has established several rules under the Texas Administrative Code, specifically the Customer Protection Rules for Retail Electric Service Providers (RULE §25.474), to safeguard consumers. One significant requirement is the clear disclosure of all charges through an Electricity Facts Label (EFL). These labels were designed to facilitate "apples-to-apples" comparisons of different electricity plans by providing standardized information on pricing, contract terms, renewable energy content, and other essential details. Theoretically, EFLs make it easier for consumers to understand and compare their options.

The number of plans with non-traditional (irregular) rate structures has increased significantly. These plans include those with rates that vary based on electricity usage times, bill credits, or other usage stipulations. Although the PUCT removed plans with bill credits from the default search on powertochoose.com in 2019 to simplify choices and enhance transparency, as of 2024, four out of the top five plans on powertochoose.com on a given day still have non-traditional rate structures. This complexity continues to challenge consumers in selecting the most cost-effective and suitable electricity plans.

Our market research concluded that 73% of consumers are influenced by these advertisements and believe the advertised plans will save them money. The use of complex rate structures, such as multi-tiered rates and time-of-use pricing further complicates the process for consumers to determine if the promoted plan will actually result in cost savings.

Study Methodology

Data Collection

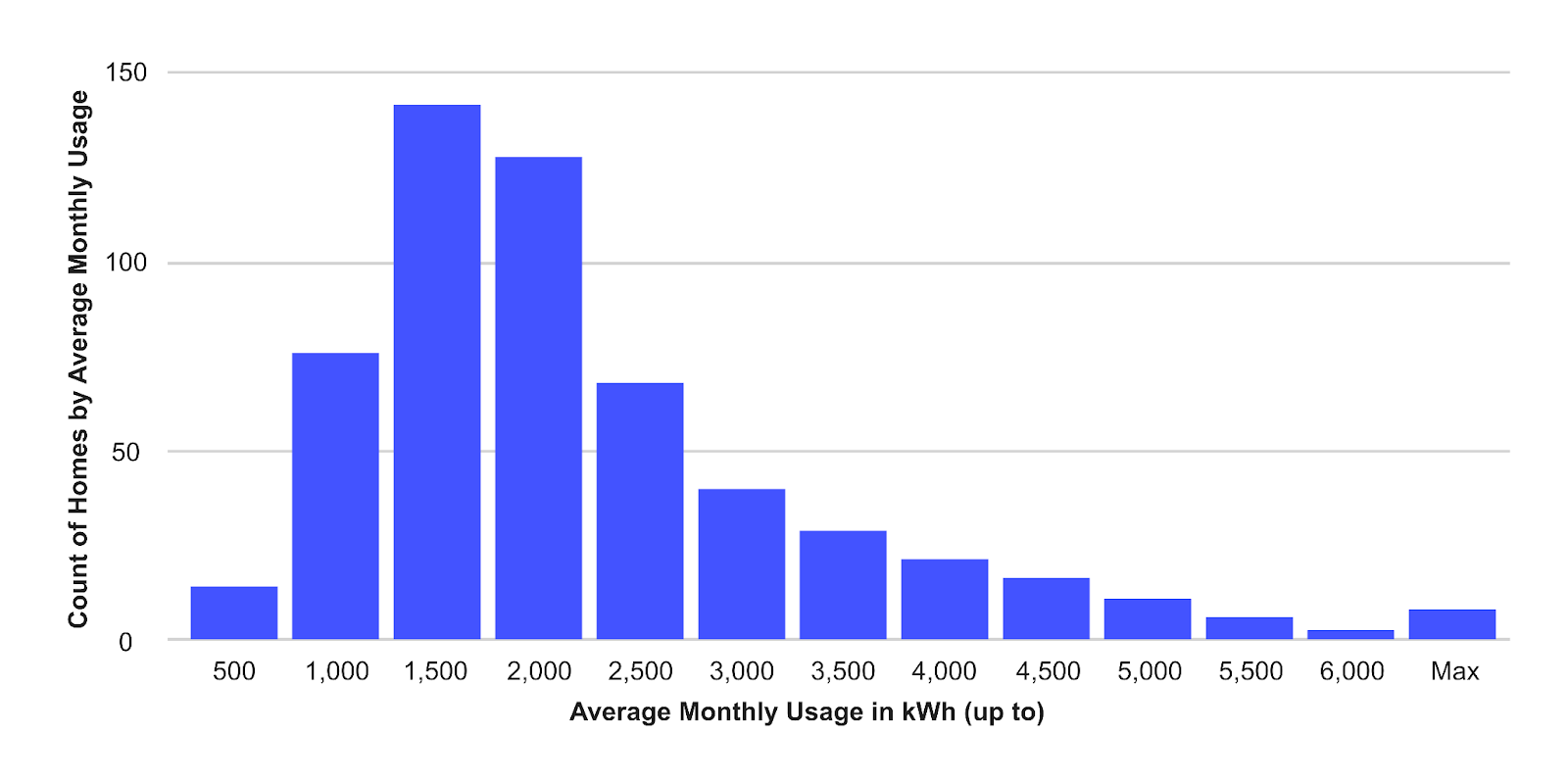

This study collected data from interval usage data for 501 participants, categorized into different household types: apartments, small homes, and large homes. The dataset includes interval usage data for 12 consecutive months for customers served by ONCOR and CenterPoint Energy (CNP).

Example of interval usage data:

Count of Homes by Average Monthly Usage

Criteria for Selecting Plans

Consumers in the deregulated markets of Texas have the flexibility to shop for an electricity plan directly with providers or through comparison shopping sites. A 2024 survey revealed that 49% of consumers in the Dallas and Houston metropolitan areas prefer shopping directly with providers, while 48% use comparison websites to find their plans (with the remaining 3% not shopping online). Additionally, 80% of consumers reported seeing advertisements for electricity plans on television, billboards, or online. Of these, 43% signed up for their current electricity plan after being influenced by an advertisement, believing it would save them money. Furthermore, 87% of consumers indicated that cost is the most important factor when selecting an electricity plan.

The plans included in this study were chosen based on this consumer feedback, reflecting the most commonly selected options.

The plans analyzed were selected from various sources:

- Highly Visible Plans: This includes plans that people are searching for online and are the most familiar to the consumers in our survey.

- Shopping Comparison Sites: These consist of plans listed at the top of the default search results on popular comparison websites, including powertochoose.com, saveonenergy.com, texaselectricityratings.com, comparepower.com, and energybot.com.

The study focused on various rate structures listed from the sources above, including:

- Traditional Plans: Plans that offer a constant rate per kWh throughout the contract period.

- Free Nights and Weekends Plans: Plans that feature different rates for peak and off-peak hours or days, encouraging consumers to shift their usage to times when electricity is cheaper. Often advertised as nights and weekend plans.

- Bill Credit Plans: Plans offering credits on the bill after certain usage thresholds are met.

- Device Specific Plans: Plans that include additional features or discounts for consumers who use specific devices, reflecting the integration of technology and energy efficiency in electricity consumption. Examples include plans that mandate the use of an EV charger or a smart thermostat to qualify for specific rates or benefits.

- Tiered Rate Plans: Plans that list different energy charges for different levels of usage.

Highly advertised plans used in this study are:

- Highly advertised plans used in this study are:

- Free Nights and Weekends Plan 1: TXU Energy Free Nights & Solar Days 12 (8 pm) (Source: TXU)

- Free Nights and Weekends Plan 2: Reliant Truly Free Nights 100% Solar 20 plan (Source: Reliant)

- Traditional Plan 1: TXU Energy Simple Rate 12SM (Texas Electricity Ratings)

- Tiered Rate Plan1: Direct Energy Live Brighter Lite 24 (ComparePower)

- Top-ranked plans listed on shopping comparison sites used in this study are:

- Free Nights and Weekends Plan 3 : Chariot Free Nights 36 (PowerToChoose)

- Device Specific Plan 1: Gexa SavEV Choice 24 (PowerToChoose)

- Traditional Plan 2: APG&E EnergyBot36 (EnergyBot)

- Bill Credit Plan 1 : Gexa Eco Saver Plus 12 (SaveOnEnergy)

- Bill Credit Plan 2 : 4CHANGE ENERGY Maxx Saver Select 12 (ComparePower)

- Bill Credit Plan 3 : Discount Power Bill Credit Bundle 24 (Texas Electricity Ratings)

Top-ranked plans listed on shopping comparison sites used in this study are:

- Free Nights and Weekends Plan: Chariot Free Nights 36

- Device Specific Plan: Gexa SavEV Choice 24

- Traditional Plan: APG&E EnergyBot36

- Bill Credit Plan: Gexa Eco Saver Plus 12

- Bill Credit Plan: 4CHANGE ENERGY Maxx Saver Select 12

- Bill Credit Plan: Discount Power Bill Credit Bundle 24

Cost Calculation

The cost calculation involved analyzing the interval usage data to determine the actual monthly and annual costs for each plan. This calculation accounted for all charges, including energy charges, supplier fees, TDU charges, and any applicable bill credits.

Formulas Used:

- Monthly cost = (Supplier Fee + TDSP Fixed monthly charge) + (Usage in kWh * Energy Charge) + (Usage in kWh * TDU Charge)

- Bill Credit Plan Monthly Cost = (Supplier Fee + TDSP Fixed monthly charge) + (Usage in kWh * Energy Charge) + (Usage in kWh * TDU Charge) - ( Bill Credit if usage criteria is met)

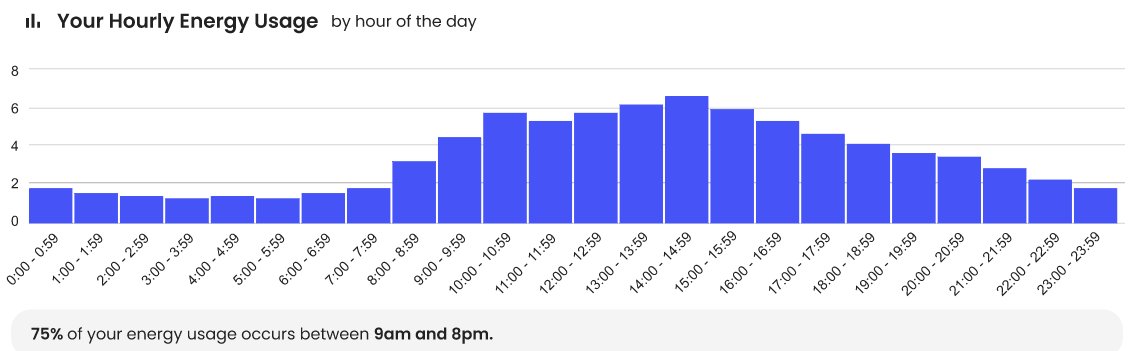

- Time of Use Monthly Cost = ((Supplier Base Charge + TDSP Fixed) + ((Average Usage Tier x Daytime Usage % x Daytime Energy Rate) + (Average Usage Tier x Free Nights Usage % x Free Nights Energy Rate) + Average Usage Tier * (TDSP per kWh + ERCOT Securitization)))

- Real Rate per kWh = Monthly Cost/Monthly usage

- Annual Cost = Sum of Monthly Costs

Data Analysis

Comparison of Advertised Rates vs. Actual Costs

The analysis revealed significant discrepancies between the advertised rates and the actual costs paid by consumers.

Advertised Rates of Selected Electricity Plans (Rates displayed on the EFL)

*The pricing and plans listed above were captured on June 26, 2024. Please note that these plans are subject to change and may no longer be current.

*EnergyBot will continuously run cost comparisons to provide the most up-to-date and accurate representation of the current market conditions.

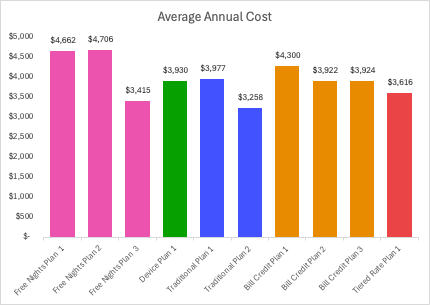

Actual Cost Analysis of Selected Electricity Plans

The calculated Real Rate takes seasonality into account: how usage changes over the course of the year by using real interval usage data from each month throughout the year.

Complexity in Cost Calculation

The study found that the real rate of electricity often deviated from the advertised rate by up to 45%. This significant variance underscores the necessity of calculating the actual cost of electricity based on the specific rate structure for each consumer's home to determine the most cost-effective plan. This complexity requires consumers to have a comprehensive understanding of their usage patterns and the various charges involved, which can be overwhelming and difficult to manage without proper tools and knowledge.

Impact on Consumers

Challenges in Finding the Best Plan

Selecting the most suitable electricity plan remains a significant challenge for consumers due to the complexity and variability of rate structures. The wide array of available plans, each with its own set of rules and conditions, complicates the decision-making process. Consumers often struggle to decipher multi-tiered rates, time-of-use pricing, and promotional credits, which can obscure the true cost of a plan.

A 2024 survey conducted in the Dallas and Houston areas presented consumers with the ten plans used in this study and asked them to select one plan to enroll for their home. Participants were provided with the supplier name, plan name, and advertised rates. Despite 87% of consumers stating that cost was the most important factor when selecting an electricity plan, 98% did not choose the least expensive plan.

Our research indicates that many consumers lack the necessary tools and understanding to accurately compare these plans, leading to suboptimal choices and potentially higher electricity bills. For instance, 50% of survey respondents selected a time-of-use plan (Free Nights & Weekends) believing it would save them money. However, as our study concluded, selecting this plan would cost the average consumer over $1,400 more than if they had chosen the plan calculated to have the lowest rate for their home. The consumer would need to change their energy usage habits to save with the Free Nights and Weekends Plan.

The perceived savings from promotional offers can be misleading, as the actual costs may differ significantly once the promotional period ends. Consequently, consumers face difficulties in identifying the most cost-effective and suitable plans for their specific needs.

Conclusion

Recap of the Study

This study aimed to investigate the discrepancies between advertised electricity rates and the actual costs incurred by consumers, focusing on the Texas deregulated electricity market. By analyzing interval usage data for 501 participants, the research highlighted the challenges consumers face in understanding and comparing electricity plans. The study also examined the impact of complex rate structures on the true cost of electricity plans.

Summary of Key Findings

Differences Between Expectation and Actual Rates: The study found that the customer’s expectations for cost and what they actually would be vary by 45%.This significant variance underscores the need for consumers to calculate the actual cost based on specific rate structures to identify the most cost-effective plans.

- Differences Between Expectation and Actual Rates: The study found that the customer’s expectations for cost and what they actually would be varies by 45%. This significant variance underscores the need for consumers to calculate the actual cost based on specific rate structures to identify the most cost-effective plans.

- Consumer Decision-Making Challenges: A 2024 survey revealed that while 87% of consumers stated that cost was the most important factor when selecting an electricity plan, 98% did not choose the least expensive option when given the opportunity. This finding highlights the significant challenge posed by the complexity of rate structures and promotional offers, which often lead consumers to make suboptimal choices and result in potentially higher electricity bills.

- Complexity of Rate Structures: The complexity of electricity rate structures, including multi-tiered rates, varying TDU charges, and promotional credits, makes it difficult for the average consumer to accurately determine the true cost of a plan. This complexity requires a comprehensive understanding of usage patterns and the various charges involved.

- Necessity for a Real Rate Calculation Tool: The study emphasizes the necessity for a tool that calculates the real rate for each consumer based on their specific home and usage patterns. Such a tool would enable consumers to better understand the actual costs associated with different electricity plans, facilitating more informed decision-making and helping them select the most cost-effective options.